| When the US Dollar gets stronger, it takes fewer dollars to buy any commodity that is priced in $USD. When the US Dollar gets weaker it takes more dollars to purchase the same commodity. The price of all US Dollar denominated commodities, like gold, will change to reflect the fact that it will take fewer or more dollars to buy that commodity. So it’s quite possible, in fact it’s almost always the case that a portion of the change in the price of gold is really just a reflection of a change in the value of the US Dollar. Sometimes that portion is insignificant. But often the opposite is true where the entire change in the gold price is simply a mathematical recalculation of an ever-changing US Dollar value. When the dollar gets strong, gold appears to go down, and vice versa. That accounts for part of the fluctuations that we see in the value of gold. The other part is an actual increase in the supply or demand for gold. If the price is higher when being measured not only in US Dollars, but also in Euros, Pounds Sterling, Japanese Yen, and every other major currency, then we know the gold demand is higher and it has actually increased in value. Consequently, if gold is higher in US Dollars while at the same time cheaper in every other currency, then we can conclude that the US Dollar has weakened, and that gold has actually lost value in all other currencies. But the price, because it is being quoted in $USD will be higher and give the illusion of gold becoming more valuable. In such a case the devaluation of gold, due to increased supply on the market, is camouflaged by a weakened US Dollar. |

|

1 Comment

Gold is bright yellow and has a high luster. Apart from copper and caesium it is the only non white colored metal. Gold’s attractive warm colour has led to its widespread use in decoration. The arrangement of outer electrons around the gold nucleus is the reason for the yellow color; to be precise, the transition of electrons from the d band to unoccupied positions in the conduction band. Finely divided gold, like other metallic powders, is black; colloidally suspended gold ranges in color from ruby red to purple.Gold can mixed with other metals to give it different colors. White gold is very popular right now. It can be in 18-karat or 14-karat gold (but not in 22-karat, as it is yellow gold). There are two basic types of white gold alloys: white gold mixed with nickel and white gold mixed with palladium. Nickel can be mixed with gold to create a white or gray color, but some people have an allergy to nickel. Palladium is another metal used to create white gold. Palladium is better but it costs more. To enhance the whiteness, almost all white gold is plated with rhodium, a shiny, white metal which is extremely hard. Depending on the amount of wear to a piece of jewelry, over time this rhodium plating may wear off, revealing the original metal color. Copper creates pink and rose tones in gold.The more the copper, the deeper will be the effect. Greenish shades are created by adding silver to gold while excluding copper from the mix. 18K green gold can be made from 75% gold and 25% silver. Cadmium can be incorporated to vary the tint of green. So combining 75% gold and 23% copper with 2% cadmium creates a light green, while 75% gold, 15% silver, 6% copper and 4% cadmium creates a dark green. Rose gold and Green gold can be 18-karat or 14-karat but the color is stronger in the 14-karat alloys. Purple gold. It is referred as amethyst or violet gold. Purple gold is obtained by mixing gold and aluminium in a certain fixed ratio. Gold content is almost 79% and therefore it is qualified to be referred to as 18K gold. Blue gold is made as an inter-metallic compound between gold and indium . The gold gets a bluish hue color with this process. Black gold is created using a few techniques. Electro-deposition using black rhodium or ruthenium is the first technique. Controlled oxidation of Carat gold containing cobalt or chromium can also be made to create black gold. Amorphous carbon is also used some times, with the Plasma Assisted Chemical Vapor Deposition process. Chocolate gold is derived from a relatively new method created in Italy. Referred to as physical vaporization and deposition, it entails placing gold (usually rose-colored) in a suction compartment and blasting it with electrodes. This approach causes the gold's surface to oxidize in a controlled environment, resulting in the metal's color changing at a molecular level and producing a rich chocolate color. This permanently alters the metal and can only be removed by scraping off the outer layers ALLOY NAME & COMPOSITION Blue Gold 18K 75% Gold 25% Iron Yellow Gold 14K 58% Gold 4-28% Silver 14-28% Copper Yellow Gold 18K 75% Gold 10-20% Silver 5-15% Copper Yellow Gold 22K 92% Gold 4.2% Silver 4.2% Copper Green Gold 18K 75% Gold 11-15% Silver 13-0% Cadmium Red Gold 18K 75% Gold 25% Copper Sterling Silver 92.5% Silver 7.5% Copper White Gold- 90% Gold 10% Palladium White Gold-275- 85% Gold 8-10% Nickel 2-9% Zinc White Gold - 14Kt A58.3% Gold 17% Copper 17% Copper 7.6% Zinc White Gold - 14Kt B59% Gold 25.5% Copper 12.3% Nickel 3.2% Zinc White Gold - 18K 75% Gold 18.5% Silver 1% Copper 5.5% Zinc

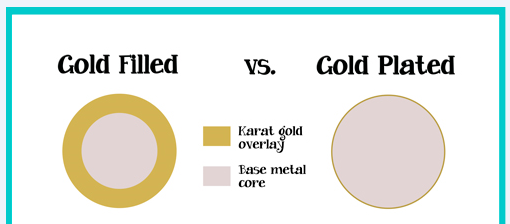

You can tell Gold-filled by the quality mark along with the manufacturer's Trademark stamped on each piece. Gold-filled must have a quality mark that will identify its Karat. For example, 1/20 12K GF and 1/20 14K GF. This means that the pieces are 1/20th 12K Gold by weight or 1/20th 14K Gold by weight. We do buy Gold-filled, but it is substantially less money than Gold.

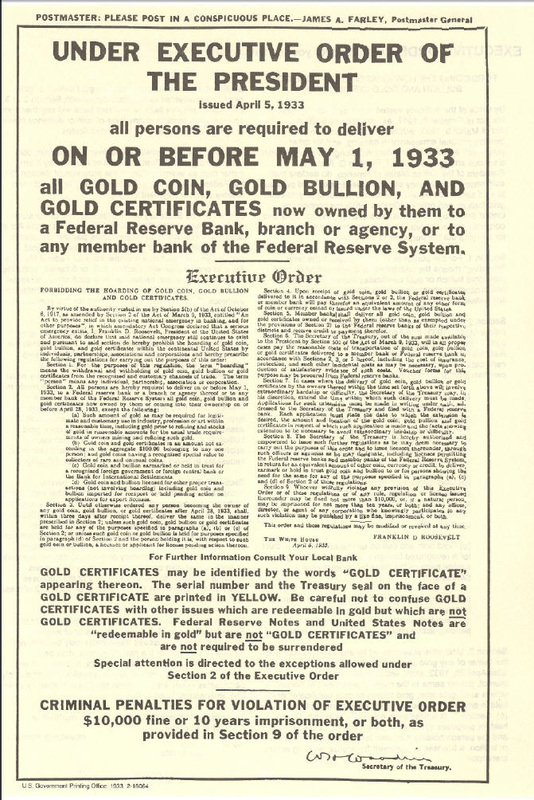

Gold-plated jewelry has zero Gold Value, the Gold color will eventually wear off as it comes into contact with the wearer's skin salts or pollutants in the air. Of course, it can inexpensively be replaced with another piece of Gold-plated jewelry. We Do Not buy Gold Plated Jewelry Did you know that for more than a generation, Americans were barred from owning certain quantities of gold coins and bars?

Gold has always fascinated people, due to its scarcity but also for some other characteristics, such as that it never oxidizes. Below you will find some less well-known facts about gold.

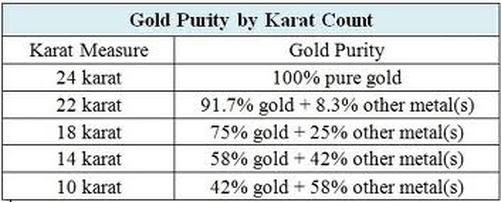

Compared to other metals, gold is much softer. One can beat 1 gram of gold to a 1 square meter sheet and light would shine through that sheet. Very few chemicals can attack gold, so that’s why it keeps it shine even when buried for 1000’s of years. A total of eighty-eight thousand tons of gold have been extracted from earth since first found. This means all the gold that has been dug up so far in history would, if melted, make a cube measuring approximately 25x25x25 meters. 75% of all gold ever produced has been extracted since 1910; much of the gold mined throughout history is still in circulation in one form or another. Gold is very rare compared with diamonds. Gold is one of the heaviest metals in the world. For example, it is 19,3 times as heavy as water. One cubic meter weights some 19.300 kilogram. The biggest gold nugget that has ever been found weighed approximately 90 kilogram and was unearthed in Australia. Out of one ounce of gold (app. 31 gram) one can make a wire almost 100 kilometer long. The word Gold derives from the Old English word Gelo meaning yellow. The world's oceans hold a vast amount of gold, but in very low concentrations (perhaps 1-2 parts per 10 billion, which means every cubic kilometer of water contains 10 to 20 kg of gold). In 2008 China overtook South Africa as the world's largest gold producer, the first time since 1905 that South Africa has not been the largest. Switzerland was the last country to tie its currency to gold; it backed 40% of its value until the Swiss joined the International Monetary Fund in 1999. Although the price of some platinum group metals can be much higher, gold has long been considered the most desirable of precious metals and its value has been used as the standard for many currencies in history. Absolutely pure gold is so soft that it can be moulded with the hands. According to some, there’s enough gold in the Earth’s crust to cover the entire land surface knee-deep. No one is completely sure where gold comes from. The relative average abundance in our Solar System appears higher than can be made in the early universe, in stars, and even in typical supernova explosions. Some astronomers now suggest that neutron-rich heavy elements such as gold might be most easily made in rare neutron-rich explosions such as the collision of neutron stars. Since neutron star collisions are also suggested as the origin of short duration gamma-ray bursts, if you own some gold it is possible that you have a souvenir from one of the most powerful explosions in the universe. It is estimated that at the end of 2009 there was a total of 165,446 tonnes of gold dug up. That boils down to some 25 grams of gold per person on the planet. According to calculations the total amount of gold yet to be retrieved from the Earth is about 100,000 tons. At price of $1205.5 an ounce, the value of all the gold in the world is $6,412,310,567,488 or $958 for each person on the planet. Since ancient times, the purity of gold has been defined by the term karat, which is 1/24 part of pure gold by weight. Pure gold is equivalent to 24K.

Gold purity may also be described by its fineness, which is the amount of pure gold in parts per 1000. For example, a gold ring containing 583 fine gold has 583 parts (58.3%) gold and 417 parts (41.7%) of other base metals. Federal Trade Commission rules require that all jewelry items sold in the United States as gold shall be described by “a correct designation of the karat fineness of the alloy.” 1964 was the last year that circulating U.S. coins were struck in 90% silver.

The composition of U.S. coins has changed considerably over the past few decades. Because of a growing worldwide silver shortage, the Coinage Act of 1965 authorized a change in the composition of dimes, quarters, and half-dollars, which had been 90 percent silver. Silver was eliminated from the dime and the quarter. The half-dollar's silver content was reduced to 40 percent and, after 1970, was eliminated altogether. This applies ONLY to coins minted for everyday use with the general public. All dollar coins dated 1971 and later are either cupronickel or brass. Nickels have always been made from copper and nickel, except during WW2 when they contained a small amount of silver. There has never been a 90% silver nickel. For circulating coinage: -- Dimes and quarters were 90% silver until 1964, and clad copper (that is, no silver) from 1965 onwards. -- Half dollars were 90% silver until 1964, 40% silver 1965-1970, and clad after that -- Silver dollars were 90% silver through 1935 and not made again until 1971. There were some 40% silver ones made for collectors, but circulation dollars were made of clad copper-nickel until 1999. The "golden" dollars came along in 2000 - but they're brass, and contain neither silver nor gold. The mint continues to make silver commemorative and bullion coins, as well as silver versions of dimes, quarters and half dollars, for collectors - these are sold at a premium to face value and are unlikely to ever be found in pocket change. WE BUY ALL GOLD AND SILVER! Bring in your U.S. coins for CASH TODAY!! If you watch television, read newspapers or read magazines, you have most likely seen one or more"we buy gold" ads. As the price of gold continues to spiral upwards, so have the gold buying scams and schemes. |

Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed